- calendar_month November 26, 2024

- folder First Time Buyers

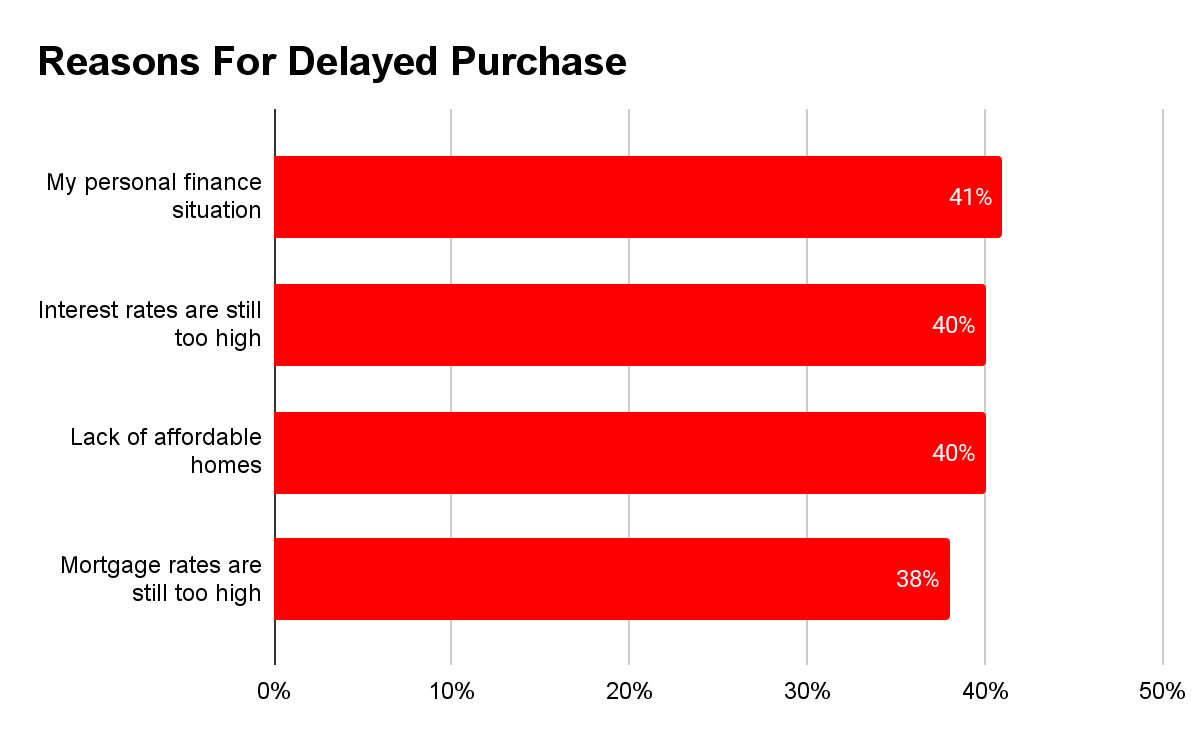

The real estate market is experiencing a fascinating paradox. Inventory is up in many areas, yet buyer activity remains sluggish. Why? New research sheds light on the top 4 reasons buyers are hesitant to jump into homeownership right now.

1. High Mortgage Rates Still Reign Supreme: While slightly down from their peak, mortgage rates hovering around 7% continue to be a major deterrent. This is especially true for repeat buyers who may have locked in significantly lower rates on their current homes. The prospect of trading a 3% mortgage for a 7% one is understandably unappealing.

2. Financial Uncertainty Fuels Hesitation: The current economic climate has many potential buyers, especially first-timers, feeling uncertain about their finances. Rising costs of living, inflation, and job security concerns all contribute to this hesitation. Saving for a down payment and managing monthly mortgage payments feels daunting in this environment.

3. Affordability Remains a Key Barrier: Even with increased inventory, affordability is still a major hurdle. While price growth has slowed in some markets, prices remain elevated compared to pre-pandemic levels. This is particularly challenging for renters, who are more likely than homeowners to cite lack of affordable options as a reason for delaying their purchase.

4. The Psychology of a Shifting Market: Beyond the tangible factors, there's also a psychological element at play. After a period of rapid price appreciation and frenzied bidding wars, the market has shifted. Buyers are now taking a more cautious approach, waiting to see how things play out. This "wait-and-see" attitude contributes to the current standstill.

What Can Real Estate Professionals Do?

Now more than ever, buyers need guidance from experienced and knowledgeable real estate professionals. Here are some ways to help potential buyers navigate this challenging market:

- Provide Realistic Expectations: Be upfront about the current market conditions, including higher interest rates and affordability challenges. Help buyers understand what they can realistically afford and manage expectations.

- Offer Personalized Financial Guidance: Connect buyers with reputable lenders and financial advisors who can help them assess their financial readiness and explore different financing options.

- Highlight Affordable Options: Focus on showcasing properties that fit within buyers' budgets and highlight any available down payment assistance programs or other incentives.

- Be a Patient and Supportive Partner: Buying a home is a big decision, especially in uncertain times. Be patient with hesitant buyers and provide ongoing support and guidance throughout the process.

- Stay Informed: Keep up-to-date on market trends and share relevant information with your clients. This will help them make informed decisions and feel confident in their choices.

By addressing these concerns head-on and providing expert guidance, my team and I can help buyers overcome their hesitations and achieve their homeownership dreams.